About Medicare plans

The four parts of Medicare and what they cover

Medicare Part A: Hospital insurance

Part A covers:

- Up to 150 days in the hospital

- Up to 100 days in a skilled nursing facility (after a 3-day qualifying inpatient hospital stay)

- Home health care

- Hospice care

You’re responsible for:

- Copays

- Deductibles

- Coinsurance

Medicare Part B: Medical insurance

Part B covers:

- Doctor visits (outpatient care, medical supplies and preventive services such as lab tests and screenings)

- Outpatient surgery

- Ambulance (in an emergency)

You’re responsible for:

- Monthly premium

- Copays

- Deductibles

- Coinsurance

Gaps in Original Medicare

Original Medicare covers a lot, but it doesn’t pay for all the health care you may need. If you only have Part A and Part B coverage, you’ll pay the full cost for services Original Medicare doesn’t cover, including:

- Routine dental care

- Hearing aids

- Routine eye exams and eyewear

- Routine physical exams

- Fitness club memberships

- Over-the-counter drugs you may take at home

- Care in a skilled nursing facility without a qualifying 3-day hospital stay

- Most care you receive when traveling outside the U.S.

- No out-of-pocket maximum

Medicare Supplement plans, also called "Medigap", pay some of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn't cover. They are another option - in addition to Medicare Advantage plans - to add more coverage beyond Original Medicare. These plans are offered by private health care companies. They do not include Medicare Part D.

Medicare Part C: Medicare Advantage plans

Part C is also known as Medicare Advantage. These are private plans that cover everything Original Medicare does, plus many include prescription drug coverage and other extras.

Medicare Advantage plans cover:

- Everything Original Medicare covers

- Extras like eyewear, dental and fitness benefits (depending on the plan)

- Many also include Medicare Part D outpatient prescription drug coverage

You’re responsible for:

- Monthly premiums

- Copays

- Deductibles

- Coinsurance

Medicare Part D: Outpatient prescription drug coverage

You can purchase Medicare Part D coverage from private health care companies to help cover the cost of your prescriptions. There are two ways to get Part D:

- As part of a Medicare Advantage plan (MA-PD)

- As a separate, standalone prescription drug plan (PDP)

Medicare Part D covers:

- Prescription drugs you take as long as they are on your plan’s drug list or formulary. Drug lists vary by plan, so it’s important to check that your prescriptions are included before you pick a plan.

A note on penalties

You don’t have to get a Part D plan when you enroll in Medicare. But if you don’t sign up when you first become eligible, you may pay a late enrollment penalty if you decide to sign up later. You’ll pay the penalty for as long as you have Part D coverage. To learn more about penalties related to Part D enrollment, visit the Medicare website.

Phases of Part D coverage

After you meet the deductible, the three phases of coverage are:

- Initial Coverage Phase: During this phase, your plan will pay part of your prescription drugs and you pay your share (a copay or coinsurance). You will remain in this phase until your total drug costs (what you and your plan pay) reach $5,030.

- Coverage Gap: Once you have reached $5,030 (your cost plus your plan's cost) in annual prescription drug spending, you pay 25% of the cost of generic and brand drugs.

- Catastrophic Coverage: Once your out-of-pocket spending reaches $8,000 (including certain payments made by other people or entities on your behalf), you'll pay nothing for your covered Part D drugs for the rest of the calendar year.

You’re responsible for:

- Monthly premiums

- Copays

- Deductibles

- Coinsurance

When to enroll in Medicare

Most people are eligible for Medicare at age 65. If you’re already receiving Social Security benefits, you will be enrolled automatically.

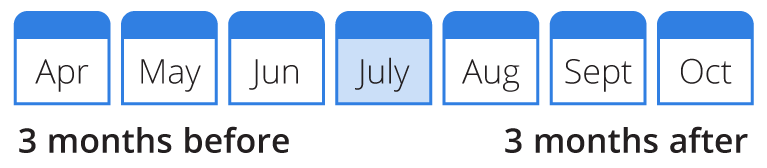

If you’re not receiving Social Security benefits, you will need to sign up for Medicare. You have seven months to sign up for Medicare – three months before your 65th birthday, the month of your 65th birthday and three months after your 65th birthday.

Example: Your birthday: July 4

Check with your employer if you need to enroll in Medicare first because there is the option to wait to enroll. If you or your spouse plan to keep working and have active employer group coverage with a large employer, you can wait to enroll.

Delaying enrollment

You can wait to enroll in Medicare if you plan to keep working after age 65 and have coverage through your employer or your spouse is working and you are covered by your spouse's employer.

If you wait to enroll in Part B and are not covered through an employer plan, you will only be able to sign up between January 1 and March 31 during the General Enrollment Period.

How to enroll in Medicare

You can sign up for Medicare three ways:

- Online at www.ssa.gov

- By calling Social Security at 1.800.772.1213 (TTY users 1-800-325-0778).

- In person at a Social Security office

When can I enroll in a Medicare Advantage plan

When you become eligible for Medicare (either by age or disability), you may enroll in Original Medicare and a Medicare Advantage plan during your Initial Coverage Election period (ICEP). (same timeframe as shown above in When to enroll in Medicare).

When can I make changes to my Medicare coverage?

Initial Enrollment

This is when you first become eligible for Medicare.

Annual Election Period

After your initial enrollment, you can make changes to your plan choices for the following year during the Annual Election Period (AEP) from October 15 to December 7.

Special Enrollment Periods

You may qualify for a Special Enrollment Period at any point during the year if you:

- Are leaving or losing coverage through an employer or union (including COBRA)

- Move to an area where your current plan isn't offered

- Are on Medical Assistance or no longer qualify for it

- Receive Extra Help for Medicare Part D

- Are losing your current coverage or your plan is no longer offered

Medicare Advantage Open Enrollment Period

This period is from January 1 to March 31 every year, or if you are newly eligible to Medicare, within the first three months. If you are enrolled in a Medicare Advantage plan, you can change plans once during this time. You can enroll in another Medicare Advantage plan or disenroll from your plan and return to Original Medicare.

In addition to these election periods, there are special circumstances in which you can enroll or make changes called Special Election Periods (SEP). For example, if you were covered by your employer’s plan and didn’t enroll during the initial enrollment period or you moved to a new area with different plan options.

For all of the details on enrollment guidelines and requirements, visit www.Medicare.gov.

Researching your Medicare Plan options (PDF)

Medicare Basics Guide (PDF)